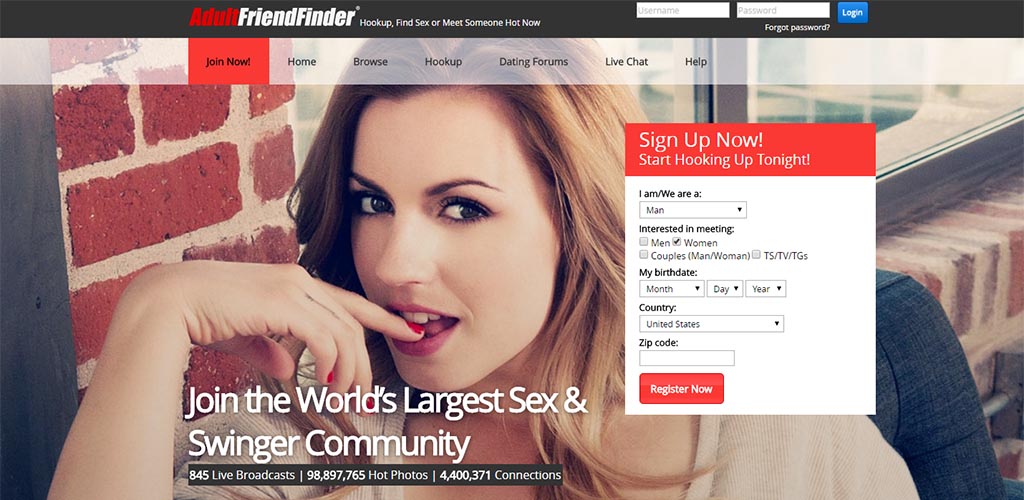

Real Free No Membership Hook Up Usa

A lot of features are available for users with free membership. Do you want to meet and hook up with educated lonely singles looking for partners? The site is 100% free, and there are no hidden charges. People to find their true love, especially when the hook-up is trending as a better option. Most popular categories Our number #1! Other readers were also interested in.

According to the Bureau of Labor Statistics, the average American spent $1,968 on gasoline, other fuels, and motor oil in 2017—a number likely to be even higher with the recent price increases at the pump. So having a credit card that offers good rewards for your gas purchases can help you rack up some serious rewards. But, if you'll be on the road a lot, these cards can offer more benefits than just savings at the pump. For example, if you occasionally rent cars, some of these cards offer additional insurance coverage that can save you even more.

If you want a credit card that offers great rewards for your gas purchases, one of these six choices could be the best credit card for you:

How We Evaluated

I'm a travel writer who has been covering credit cards for the last six years and studying card benefits for many years longer, so I know what benefits travelers need and use. To examine cards for gas purchases, I looked at major credit cards that offer the best returns for purchases made at gas stations. The top cards were chosen based on the value of rewards (both points and perks), fees, and other driving-related benefits. While many of the more well-known credit cards don't offer great rewards for gas purchases, there are some worthwhile options out there.

Things To Know About Credit Cards

- Most of these cards come with an annual fee, but some cards offer perks each year that are worth more than the fee total. The Citi Premier Card is probably the best example of this.

- APR rates and credit limits vary based on your individual credit. Credit limits and interest rates for each card are determined based on each cardholder's personal situation, so we did not take that information into account when evaluating these cards. One thing to remember is that if you pay your card off in full every month, you will not be charged interest.

- Banks have final say on who they accept for a credit card. These recommendations were put together with the assumption that applicants would have average credit or above. That being said, banks decide who they will issue credit cards to using criteria including, but not always limited to, an individual's credit score when evaluating each applicant.

Best Overall: Wells Fargo Propel

Wells Fargo Propel American Express

(Photo: Reviewed / Naidin Concul-Ticas)The Wells Fargo Propel is the best option for buying gas, and many other purchases, because it earns strong rewards in a large variety of categories. The points that Propel cardholders earn are worth a fixed amount toward a cash redemption, making it simple to see your benefits add up. One aspect that makes this card our best value, in addition to our best overall: There's no annual fee, so everything you earn extra money from the get-go.

Points: As far as earning points goes, you'll get 3 points per dollar spent on gas, car rentals, eating out and ordering in, rideshare services like Uber and Lyft, transit, flights, hotels, and popular online streaming services. You'll earn 1 point per dollar spent on all other purchases. Each point is worth 1 cent ($0.01), so the card effectively earns 3% back on all of the bonus categories and 1% back on all other purchases.

Perks: The Wells Fargo Propel card comes with some awesome perks. When in North America, you'll benefit from secondary car rental loss and damage insurance. This means that you don't have to pay extra for the rental company's collision or damage-waiver insurance, but if you need to make a claim, you'll have to go through your personal car insurance first. You won't be charged foreign transaction fees when you travel abroad (though American Express isn't always accepted in other countries). Additionally, if you pay your monthly cell phone bill with your Propel card, you will benefit from up to $600 per claim in cell phone protection to protect your phone from both damage and theft, subject to a $25 deductible.

Citi Premier

Citi Premier

(Photo: Reviewed / Naidin Concul-Ticas)Experts and consumers alike talk about the Citi Premier Card fairly regularly as a good travel card, but it is also a good gas card. It earns flexible points called ThankYou points that can be redeemed for cash back, used to book travel directly through Citi, or transferred to Citi's airline transfer partners. This card has a $95 annual fee, which is waived the first year.

Points: The Citi Premier Card earns 3 ThankYou points per dollar spent on travel, including at gas stations, 2 ThankYou points per dollar spent at restaurants and on entertainment, and 1 ThankYou point per dollar spent on all other purchases. If you redeem your ThankYou points for cash back, they are worth one cent each ($0.01), and if you redeem them for travel through Citi's travel portal they are worth 1.25 cents each ($0.0125). That means you are getting 3 to 3.75% back on your travel purchases, 2 to 2.5% back on your dining and entertainment, and 1 to 1.25% back on everything else when you spend with your Premier card. If you transfer your points to Citi's partners, the value you get from your points can be significantly more or less, depending on the current dollar cost of the flight (the mile cost for flights booked with travel partners is generally static, so if the dollar cost is up, you could save with transferred miles).

Perks: The Citi Premier Card also has other great benefits. For starters, if you ever rent a car, you'll benefit from its secondary rental car insurance coverage, so you can pass on the rental agency's extra insurance. However, like the Wells Fargo Propel Amex, if you ever need to make a claim, you will be required to file with your own car insurance first. You'll also never be charged foreign transaction fees when you travel abroad.

Blue Cash Preferred from American Express

American Express Blue Cash Preferred

(Photo: Reviewed / Naidin Concul-Ticas)The Blue Cash Preferred Card from American Express is a great cash-back card with the same return for gas purchases as the Wells Fargo Propel American Express Card. However, it earns a lower rate on most other categories and has a $95 annual fee.

Points: The Blue Cash Preferred Card gives you 3% cash back on any money spent at gas stations. Its best benefit is the 6% cash back on the first $6,000 per year on spending at grocery stores (and then 1% at grocery stores after $6,000), but it offers just 1% cash back on all other purchases. You can redeem your cash back as an account credit or for gift cards.

Perks: The Blue Cash Preferred Card doesn't have many additional perks, but it does offer secondary car rental insurance coverage in most places in the world, except in Australia, Italy, and New Zealand. You'll also have access to the Roadside Assistance Hotline to connect you quickly with help if you ever get stranded on the side of the road, but additional costs are your responsibility. This card charges a 2.7% foreign transaction fee, so it's not a good choice for purchases made abroad.

Amex EveryDay Preferred

Amex EveryDay Preferred

(Photo: Reviewed / Naidin Concul-Ticas)The Amex EveryDay Preferred card offers good bonus categories and gives you an additional bonus if you use your card at least 30 times per month, making it a good option for an everyday credit card. This card has a $95 annual fee.

Points: The Amex EveryDay Preferred Credit Card offers 3 Membership Rewards points per dollar spent at supermarkets (on the first $6,000 in annual spend, after that 1 ThankYou point per dollar), 2 Membership Rewards points per dollar at gas stations, and 1 Membership Reward point per dollar on all other purchases. If you make at least 30 purchases on your card each month, you'll get a 50% bonus on the number of points you earn. That means you can really earn 4.5 points per dollar at supermarkets, 3 points per dollar at gas stations, and 1.5 points per dollar on all other purchases. These points can be redeemed for gift cards, redeemed for a statement credit, used to book travel through Amex Travel, or transferred to American Express' hotel and airline partners.

Perks: The Amex EveryDay Preferred doesn't have many additional perks, but it does offer secondary car rental insurance coverage around the globe, except in Australia, Italy, and New Zealand. You'll also have access to the Roadside Assistance Hotline if you ever get stranded on the side of the road, but additional costs are your responsibility.

Sam's Club Mastercard

Sams Club Mastercard

(Photo: Reviewed / Naidin Concul-Ticas)The Sam's Club Mastercard is a great option for gas purchases, offering a category-leading 5% return up to your first $6,000. While this card doesn't have an annual fee, you have to be a Sam's Club Member to get it. Sam's Club Memberships start at $45 per year.

Points: The Sam's Club Mastercard gives you 5% back on gas purchases (up to $6,000 in purchases per year, then 1% back), 3% back on travel and dining, and 1% back on all other purchases. You can earn a maximum of $5,000 in cash back during each calendar year (which would require spending $100,000 annually if you only use it for gas purchases—a self-selecting group to be sure). The rewards from the year will be automatically loaded to your Sam's Club Membership in February. (If you earn less than $5 in cash back rewards, they will be forfeited.)

Perks: The Sam's Club Mastercard doesn't charge foreign transaction fees. Unlike many of the other cards on this list, the Sam's Club Mastercard does not offer car rental insurance coverage.

Costco Anywhere Visa

Costco Anywhere Visa Business by Citi

(Photo: Reviewed / Naidin Concul-Ticas)Similar to the Sam's Club Card, the Costco card is a great option for Costco members. It offers a generous 4% back on gas purchases, up to $7,000. Costco Memberships start at $60 per year.

Points: The Costco Anywhere Visa earns 4% back on gas purchases (up to $7,000 in purchases per year, then 1%), 3% back at restaurants and on travel, 2% back on all other purchases from Costco, and 1% back on all other purchases. Cash back is awarded once per year credit card reward certificate in February. (If you earn less than $1 in rewards in a calendar year, they will be forfeited.)

Perks: The Costco Anywhere Visa offers car rental insurance coverage worldwide when you pay for your rental with your card. There are also no foreign transaction fees.

When you sign up for one of these cards, Reviewed may receive an affiliate commission from The Points Guy Affiliate Network.

Other top credit card options

The product experts at Reviewed have all your shopping needs covered. Follow Reviewed on Facebook, Twitter, and Instagram for the latest, deals, product reviews, and more.

Read or Share this story: https://www.usatoday.com/story/tech/reviewedcom/2019/05/24/best-gas-cards/1223690001/

Posted: 23 May 2019 12:22 PM PDT Starting a company? Whether it's a small business or a venture-backed startup, these credit cards can help your enterprise's bottom line. (Photo: Getty Images / Jirapong Manustrong)— Our editors review and recommend products to help you buy the stuff you need. If you sign up for a credit card after clicking one of our links, we may earn a small share of the revenue. However, our picks and opinions are independent from USA TODAY's newsroom and any business incentives. If you're starting up a company, big or small, one of your first orders of business should be finding a business credit card. The right card can help entrepreneurs and small business owners fund purchases, track expenses and keep costs low—all while earning rewards. Whether you're opening your own small business or starting up the next unicorn, your company will grow beyond just one person. (If you're planning on staying solo during your business venture, check out our best credit cards for freelancers and sole proprietors.) The best business credit cards allow you to set up employee cards and build business credit so you can qualify for other types of loans down the road. If you keep your future needs in mind while you're choosing your business credit card, you won't be stuck with a card that causes later hassle when you're focused on growing. There are a number of business credit cards out there, each with their own perks and points system, and the right choice will save your time and earn you rewards over the long run. Whether you're a startup founder, contractor, restaurant owner, or run some other type of business, these seven credit cards can address your needs. How We EvaluatedI've been working in the personal-finance space for nine years, so I know how to maximize value when it comes to your own finances and your business's. I looked at business credit cards from the major issuers and measured their benefits, rewards, costs, and how cardholders might use the card and redeem rewards. Small-business owners may be looking to grow in the future, so they need a product that helps them build business credit, provide a high credit limit, set up employee cards and manage expenses. And because the IRS requires business owners to categorize expenses and income for tax purposes, it's a nice draw if the credit card offers an app that handles expense tracking for you. Before applying for a business credit card, ask the issuer a few questions:

These recommendations were put together assuming the primary applicant would have average to excellent credit. However, banks have the final say on who's approved. Be prepared for the issuer to check your credit history and use its own set of criteria when evaluating your application. Things To Know About Business Credit Cards1. Nearly every business card requires a personal guarantee, which is an agreement between the business owner and the credit card issuer. It means the issuer can go after your personal assets to satisfy any balance owed if your business defaults on the card payments—even if you leave the company. That goes for expenses you or your employees charge to the credit card. 2. Using your business credit card can help you build business credit, which can be useful if you need a business loan in the future. Here's a quick rundown on how it works: Business credit card issuers can report your account activity to both the personal credit reporting agencies and the business reporting agencies, such as Dun & Bradstreet and Experian. These agencies use the information in your report to create a credit score for your business, which helps lenders measure risk before extending you credit. If you're worried about this card affecting your personal credit, ask the issuer how it will report your payments (before applying for the card). 3. The Credit Card Accountability Responsibility and Disclosure Act of 2009, better known as the CARD Act, is a law that improved consumer protections. It regulates how interest rates, fees and finance charges are calculated on credit cards and provides more transparent rules that issuers have to follow. The law doesn't extend to business credit cards, though some issuers are extending the CARD Act's protections to its business products. Get to know the card's features and terms before you apply for a business card—and ask questions—so you don't get dinged with unexpected fees. Best overall: American Express Business Gold CardAmerican Express Business Gold (Photo: Reviewed / Naidin Concul-Ticas)This card's bonus rewards program adjusts to your business's spending habits, which is a no-fuss way to supercharge your rewards. There's no preset spending limit on the card itself, and the bonus categories have a high spending cap, which could help if you need room to make a lot of purchases and earn rewards on them. The annual fee is $295, which is a bit more affordable than what you'll pay for The Business Platinum Card. If your expenses vary from month to month and you plan to take advantage of the ZipRecruiter Standard and G Suite Basic benefits, this card could be a good fit for your business. Ongoing rewards: You'll be earning points on any employee cards you set up, for a number of different business expenses including travel, computer equipment, shipping, and advertising, which could go a long way in helping you get your business off the ground. Specifically, you'll get 4 Membership Rewards points on up to $150,000 in combined purchases in two categories where your business spent the most each billing cycle—so if your business spends $150,000 on, say, computer equipment and online advertising, the primary account will receive 600,000 points to spend in the Membership Rewards portal, or cash out into your bank account. After that, you'll earn 1 point per dollar spent. If you book flights using points at American Express Travel, you'll get 25% of them back. The bonus categories include:

Perks: You can earn a sign-up bonus of 35,000 Membership Rewards points after spending $5,000 within three months of account opening. Plus, you'll get up to one year free of G Suite Basic—think business Gmail, Google Docs, and Google Sheets—for up to three users. You'll also get up to one year of ZipRecruiter Standard in the form of statement credits in your first 12 months of card membership, to help you get staffed up. As far as expense management goes, the card allows you to set up employee cards with customizable spending limits, transfer data from your American Express online statement directly into your QuickBooks account, and use the Spend Manager app to add receipts and notes to your transactions. Best for simplicity: Capital One Spark Cash for BusinessCapital One Spark Cash For Business (Photo: Reviewed / Naidin Concul-Ticas)Not every business owner wants to spend time on complicated rewards programs and pay a high annual fee. Spark Cash from Capital One cardholders can enjoy a refreshingly simple rewards program with a generous cash-back rate, tools that help streamline expense management, and a $500 cash sign-up bonus after spending $4,500 within three months of account opening. If your spending doesn't fit neatly into one category, the flat 2% cash-back rate lets you maximize every purchase you make, whether it's for airfare, consulting services or a Costco run to refill the snack drawer. The annual fee is $95, though it's waived in year one. Ongoing rewards: It's simple: You'll get 2% cash back on every purchase you make, which you can then redeem for any amount at any time with no expiration date. Perks: Although it's not a travel-specific rewards card, cardholders still get travel-related perks like travel and emergency assistance services, an auto rental collision damage waiver, and no foreign transaction fees. Plus, business owners can add employee cards for free and earn points on the purchases; create customized spending reports to simplify planning, budgeting and taxes; and download purchase records to multiple formats including Quicken, Quickbooks and Excel. Best for imperfect credit: Capital One Spark Classic for BusinessCapital One Spark Classic For Business (Photo: Reviewed / Naidin Concul-Ticas)Many business credit cards require good to excellent credit, so business owners with fair credit may have a hard time qualifying for a card. If you fit that description, the Capital One Spark Classic for Business is a solid option. You can earn rewards with no annual fee—while building credit. Ongoing rewards: Earn 1% cash back on all purchases, with no minimum to redeem. Perks: Cardholders get the full suite of Capital One Spark benefits, including: free employee cards that earn points for the primary account holder, customizable spending reports, and tools to download purchase records to multiple formats including Quicken, Quickbooks and Excel. Business Platinum Card from American ExpressAmerican Express Business Platinum (Photo: Reviewed / Naidin Concul-Ticas)This card is a favorite among business owners because of its incredible suite of perks, point system geared toward travel purchases, and solid sign-up bonus: 50,000 Membership Rewards points after spending $10,000 and an extra 25,000 points after spending an additional $10,000 within three months of account opening. If you plan to set up employee cards, reaching this requirement shouldn't be a problem. Plus, business owners with a lot of expenses won't have to worry about exceeding a preset spending limit, as your spending power adjusts based on your usage and other factors. The $595 annual fee is on the steep end, but the perks and rewards more than pay for it. Note, also, that this is a charge card, so you'll need to pay the balance in full every month, unless you enroll in the Pay Over Time feature. Ongoing rewards: You'll earn 5 points per dollar spent on airfare and prepaid hotel rooms on amextravel.com, 1.5 points on purchases of $5,000 or more, and 1 point per dollar spent on everything else. When you redeem points for flights, you'll get 35% of them back. Perks: There's a ton of them, mostly geared toward travel. Here's a sampling of the card's lucrative benefits:

Marriott Bonvoy Business American Express CardMarriott Bonvoy Business American Express (Photo: Reviewed / Naidin Concul-Ticas)This card could be a good fit if you and your employees are always on the go and spend a lot on accommodations during business travel. When you're loyal to the Marriott Bonvoy brand and carry this card, you can earn free hotel stays, reach elite status quicker and redeem points at more than 6,900 participating hotels worldwide—so chances are, there's a qualifying hotel wherever you go. You can also earn a high rewards rate in several bonus categories and set up employee cards, which earn points for the primary account holder and come with customizable spending limits. Although the card comes with a $125 annual fee, the perks and rewards can easily make up for it. Ongoing rewards: You'll earn 6 points for every dollar spent at participating Marriott Bonvoy hotels; 4 points per dollar spent at U.S. restaurants, at U.S. gas stations, on wireless telephone services and on U.S. purchases for shipping; and 2 points per dollar spent everywhere else. Perks: The card is stocked with them. First, you'll get a sign-up bonus of 75,000 points after spending at least $3,000 within three months from account opening. Then you'll get one free hotel night every year after the annual fee is paid, complimentary silver elite status (upgraded to gold elite once you spend $35,000 in a year), a complimentary Boingo membership with free Wi-Fi, and a 5,000-point bonus when you transfer 60,000 points to a participating frequent flyer program. Of course, this card also comes with expense-tracking tools and protections such as extended warranty and purchase protection. United Explorer Business CardUnited Explorer Business (Photo: Reviewed / Naidin Concul-Ticas)If you and your employees travel a lot but tend to spend heavily on flights, signing up for an airline credit card can help you earn more on your travel expenses. United Airlines is the second-largest carrier in the world by passenger traffic and has hubs in several large cities, which is a bonus if you and your employees are spread out. The card lets you set up free employee cards, which earn points for the master account, and offers premium onboard benefits, a sky-high sign-up bonus and ongoing rewards for flying with United Airlines. There's a $95 annual fee, though it's waived in the first year. Ongoing rewards: Earn 2 miles for each dollar spent with United Airlines and at restaurants, gas stations and office supply stores, plus 1 point per dollar spent everywhere else. Perks: You'll get a sign-up bonus of 50,000 miles after spending $3,000 within three months of account opening. Plus, your first checked bag is free and you can enjoy priority boarding. Bank of America Business Advantage Cash Rewards MastercardBank Of America Business Advantage Cash Rewards (Photo: Reviewed / Naidin Concul-Ticas)This card offers a strong cash-back program and sign-up bonus, but what sets it apart is the potential for relationship rewards. When you enroll in the Business Advantage Relationship Rewards program, you can earn an additional 25%, 50% or 75% rewards bonus on every purchase you make. If you qualify for the highest bonus, you'll earn as much as 5.25% cash back on the category of your choice, 3.5% on dining and 1.75% on all other purchases. Your rewards grow as your qualifying Bank of America, Merrill Edge or Merrill Lynch balances increase. So whether you're a freelancer with a few thousand dollars in your business checking account or a business owner with a few high-dollar investments, you could supersize your rewards potential. Ongoing rewards: You'll earn 3% cash back on the category of your choice, including business-friendly options like gas stations, office supply stores, travel, TV/telecom and wireless services, and computer services or business consulting services. You'll also earn 2% cash back on dining, and 1% on all other purchases. The bonus rates apply to the first $50,000 in combined spending in the category of your choice and on dining purchases each calendar year (1% after that). Perks: Cardholders pay no annual fee, get a 0% intro APR for the first nine billing cycles and earn a $300 sign-up bonus after spending $3,000 within 90 days of account opening. Plus, you can take advantage of free employee cards that earn points toward the primary account, a lineup of expense-management tools, and travel and emergency services. When you sign up for one of these cards, Reviewed may receive an affiliate commission from The Points Guy Affiliate Network. Other top credit card optionsThe product experts at Reviewed have all your shopping needs covered. Follow Reviewed on Facebook, Twitter, and Instagram for the latest, deals, product reviews, and more. Read or Share this story: https://www.usatoday.com/story/tech/reviewedcom/2019/05/23/best-business-credit-cards-entrepreneurs/1208401001/ |

Posted: 23 May 2019 12:03 AM PDT Great credit scores don't happen by accident. They take hard work and consistency to earn. If you have brag-worthy personal credit scores, you've probably spent years building those scores and protecting them from damage. There's no question that your personal credit can be an asset when you need to borrow money for your business. However, there's also a deeper level of risk involved whenever you put your personal credit and finances on the line to vouch for your company. It's fine to use your personal credit to help your business get ahead. But you shouldn't do so without good reason or without understanding the potential downside. What Is a Personal Guarantee?A personal guarantee is a promise made to personally repay the money a lender issues to your business in the event your company fails to pay back the financial obligation as agreed. A personal guarantee essentially makes you a co-signer on a business debt. Lenders ask for personal guaranteesbecause it reduces their risk when you, the business owner, have some skin in the game. If you have good personal credit, you may be able to secure higher limits, lower interest rates, and better terms on business financing. Should You Sign a Personal Guarantee?Before you agree to use your personal credit to secure business financing, it's crucial to understand the potential problems you could face if things go badly. A personal guarantee may reduce risk for lenders, but it increases risk for the person who is signing it. When you sign a personal guarantee, here's a look at what you might be putting on the line to help your company secure financing.

Your goal should be to eventually avoid personal guarantees as much as you can. Unfortunately, it's not always easy to steer clear of this requirement if your business is young or hasn't yetestablished a strong business credit rating. If the risk makes sense and you're comfortable putting your name on the line to secure funding, it's okay to use your personal credit for your business. If you're not comfortable with the risk, you should probably avoid it. Only you can make that decision. Avoid Using Personal Credit Cards for BusinessAccording to aNav study, small business owners have nearly twice as many credit cards as consumers. Their credit limits are also almost twice as high. While there's nothing wrong with having numerous credit cards and higher credit limits (as long as they're well managed), these numbers may be the sign of a troubling problem. Nav's Education Director, Gerri Detweiler, explains 'it can be hard for young businesses to get funding, so some small business owners are using personal credit cards to fund their startup costs and operations, but this can be a dangerous practice.'

Instead of using a personal card to cover business expenses, a small business credit card is typically a much better fit. Although small business cards almost always require a personal guarantee,many business cards won't report to the personal credit bureaus(as long as you're on time with your payments). This can protect you from lower credit scores in the event you ever run up a high utilization rate on a business credit card. Just keep in mind, should you sign a personal guarantee for a business credit card, you'll still be on the hook if your business fails to pay as agreed. Best practices for managing any type of credit card (personal or business) involve paying your balance in full each and every month. When you follow this rule of thumb, you'll avoid spending money on high interest fees plus you'll protect your credit scores from potentially being lowered due to high utilization. How to Build Business CreditIf you want to avoid personal guarantees in the future and keep your business and personal credit separate, it's important to take the time to build a solid business credit profile. Openingvendor accounts(aka trade credit) and small business credit cards can be a great start. It's also a good idea to keep your bills paid on time and pay your credit card balances off in full each month. |

Posted: 30 Apr 2019 12:00 AM PDT Financing a new business can be rough for a lot of entrepreneurs. Without substantial working capital, it's easy to find yourself falling behind on vendor payments or even monthly operating expenses until you get your cash flow situated. What's a startup to do? A lot of small business owners turn to a business credit card when they're first establishing their businesses. Not only does a business credit card serve as a reliable stop-gap when money's tight, it can also help you establish your business credit, something that can have a long-lasting impact on your ability to seek financing later for things like expanding your business. Is a Startup Business Credit Card Right for You?A credit card isn't the right solution for every business financing need, obviously, particularly if you're looking for long-term financing. But with responsible management, a business credit card can be a great business tool and can offer some pretty nice perks as well. Here are some questions to ask yourself if you're wondering if a credit card is the right choice for your business:

If you answered yes to any of these questions, a business credit card may be worth considering. They can help you do all of these things and more. We'll say it again, though: If you're looking for long-term financing with low interest rates, a credit card is likely not your best option. But for your day-to-day purchases, short-term financing of larger purchases (think 30, 60 or maybe 90 days), tracking day-to-day spending and for generating cash-back or even travel rewards, a business credit card can be invaluable. Here are some of our favorite business credit cards available today, and the particular financing options and/or rewards they are especially good for. Blue Business Plus Credit Card from American Express: 0% Introductory APRThe Blue Business Plus Credit Card from American Express is our top pick for new business owners who want financing flexibility and freedom. This card comes with a 15-month 0% introductory APR on purchases and balance transfers (there's a 3% fee on transfers). Keep in mind any remaining balance will revert to the card's variable APR once the introductory period has expired, currently at 13.24%, 17.24% or 21.24%, based on your creditworthiness and other factors as determined at the time of account opening. On top of offering the longest 0% intro APR period currently available among business credit cards, the Blue Business Plus offers some pretty nice ongoing rewards:

The Business Blue is also flexible when it comes to your business spending. You can enjoy increased buying power above your credit limit to make bigger purchases for your business. Just keep in mind the amount you can spend above your credit limit is not unlimited. It adjusts with your use of the card, your payment history, credit record, financial resources and other factors. Another nice thing about the Business Blue card is that your credit history won't be reported to the personal credit bureaus, so there's no need to worry about your business negatively impacting your personal credit should you run up your balance or fall behind on payments. Finally, there's no annual fee for the Business Blue card, and foreign transactions incur a fee of 2.7%. Chase Ink Business Preferred: Travel & Other RewardsThe Chase Ink Business Preferred is our top pick among business credit cards that offer travel rewards and other perks for one simple reason: A current welcome bonus of 80,000 Ultimate Rewards points if you spend $5,000 in the first 3 months of membership. On top of the one-time bonus, you'll earn some pretty significant rewards for your everyday purchases:

You'll get even more bang for the buck when you redeem your points for travel booked through Chase Ultimate Rewards, where the point value increases to 1.25 each. Like other Chase business cards, your credit history with the Ink Business Preferred won't be reported to the personal credit bureaus unless your account is seriously delinquent. While there's no charge for additional cards for your employees and no foreign transaction fees, there are some things to keep in mind when comparing the Ink Preferred with other cards: SimplyCash Plus from American Express: Cash Back RewardsIf you like the idea of earning significant cash back on your business purchases, plus the opportunity to finance those purchases at 0% interest for your first 9 months in business, the SimplyCash Plus from American Express may be a great card for you. To start, SimplyCash is offering a limited introductory offer. You'll earn a $250 statement credit after you spend $5,000 in qualifying purchases on your card within the first 6 months of membership. You'll earn an additional $250 statement credit after you spend an additional $10,000 or more in qualifying purchases on your card within the first year of membership. Then there's the SimplyCash Plus 0% introductory APR on purchases for the first 9 months after opening the card. Any balances will revert to a variable APR, currently at 14.49%, 19.49% or 21.49%, based on your creditworthiness and other factors as determined at the time of account opening. Finally, there's the cash back rewards. There are three tiers for rewards. Here's how it works: 3% cash back (on the category of your choice from a list of eight, up to $50,000 annually):

There's no annual fee for this card, but there is a 2.7% foreign transaction fee. Keep in mind American Express doesn't report to personal credit bureaus, so high balances or missed payments aren't going to hurt your personal finances. Chase Ink Business Unlimited Credit Card: Simple Cash Back RewardsTo start, you'll earn $500 bonus cash back after you spend $3,000 on purchases in the first 3 months from account opening. The Ink Business Unlimited also offers a 0% introductory APR on balance transfers and new purchases for 12 months. That's a nice little chunk of worry-free financing for your first year in business. Just keep in mind that any balance remaining after the introductory period will revert to a 15.49% - 21.49% variable APR, depending on creditworthiness and other factors. When it comes to cash back, there's no limit to the 1.5% you'll earn on every purchase you make. There's also no fee for additional credit cards for your employees, and there's no annual fee. And, similar to Amex, Chase won't report your business credit history to the personal credit bureaus unless your account is seriously delinquent. Capital One Spark Classic: Fair or Average CreditIf all the perks of the previous cards sound great, but you know you probably won't qualify because your credit isn't all that great, you may want to consider the Capital One Spark Classic. Let's take a look at what makes this card stand out: Unlike a lot of business credit cards for people with less-than-stellar credit, the Capital One Spark Classic has no annual fee and even offers cash back rewards. It's just 1%, but it's cash back on every purchase you make for your business, with no minimum to redeem. Keep in mind if you're going to carry a balance, the card comes with a variable APR on purchases of 25.24%, which is pretty high compared to other cards on this list. That could jump to 31.15% if you get behind on your payments. Of course, if you're looking to build your credit and think you won't carry a balance too often, the Spark Classic is a great way to improve your credit history so you can graduate to higher-rewards cards with lower interest rates. Keep in mind that this card will report your credit history to the personal credit bureaus, which can actually be a good thing, improving your credit scores as long as you properly manage your balances and payments. The Bottom LineEditorial Disclosure: Inc. writes about products and services in this and other articles. These articles are editorially independent - that means the editors and reporters who research and write about these products are free of any influence of any marketing or sales departments. In other words, no one is telling our reporters or editors what to write or to include any particular positive or negative information about these products or services in the article. The article's content is entirely at the discretion of the reporter and editor. You will notice, however, that sometimes we include links to these products and services in the articles. When readers click on these links, and buy these products or services, Inc may be compensated. This e-commerce based advertising model - like every other ad on our article pages - has no impact on our editorial coverage. Reporters and editors don't add those links, nor will they manage them. This advertising model, like others you see on Inc, supports the independent journalism you find on this site. |

How to start

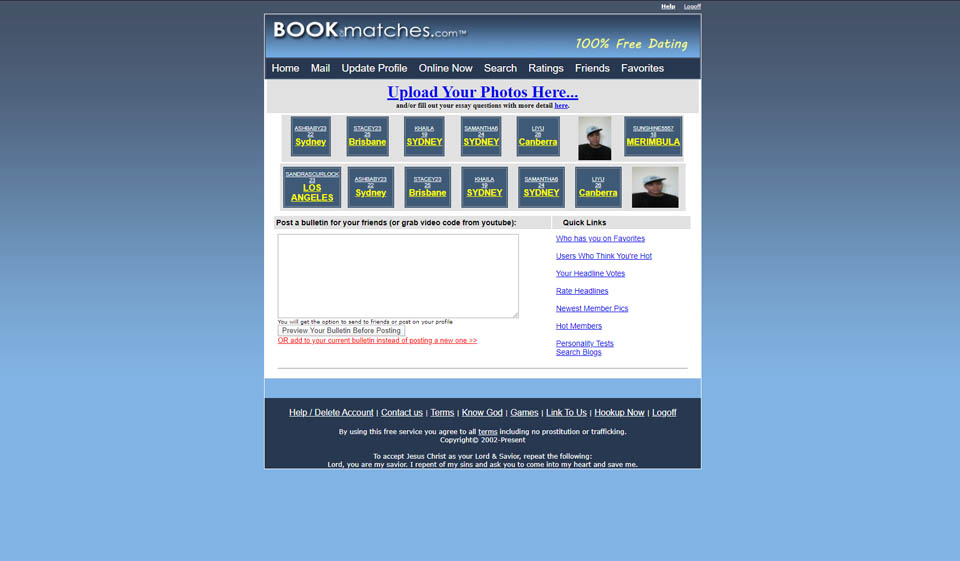

Create profile

Take a minute to fill in your profile and tell the world about yourself.

Real Free No Membership Hook Up Usa Videos

Upload pictures

A picture is worth a thousand words. Upload as many pictures as you like.

Browse our users

Browse through thousands of our personals to find the right one just for you.

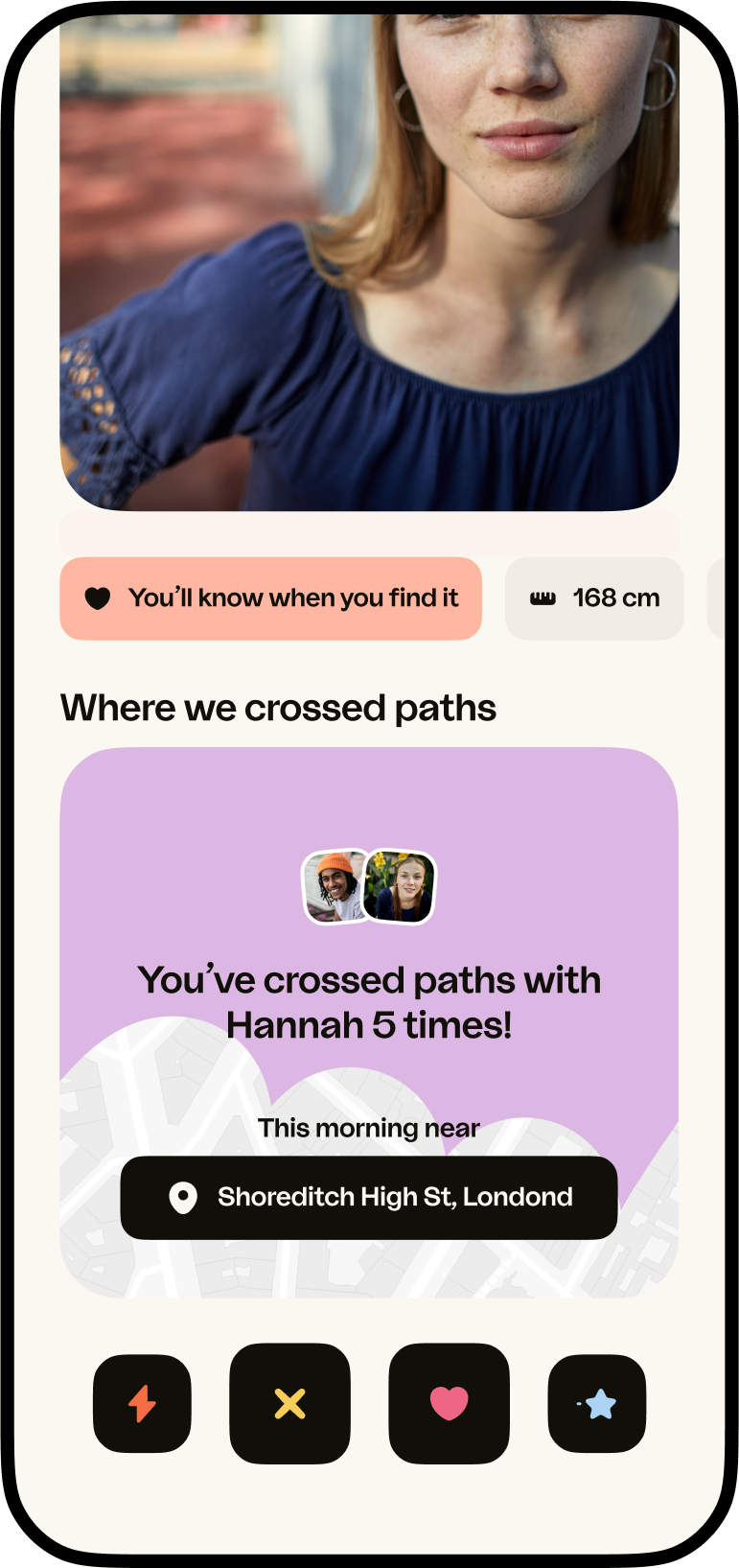

Gone are the days when dating was all about coincidences and people waited to be asked by their crushes; now is the time when online dating has popularized way too much. Even those that thought finding a date was really difficult, are now seen with gorgeous partners. If you are finding a date, prefer online dating websites to choose the perfect person. However, before you do that, read the following FAQs to be sure of this concept:

Why online dating?

If you ask me why online dating, I'd ask you why NOT online dating? If you have spent years together dating the wrong men or women in your life, it is time for you to find that perfect partner in the virtual world of internet. Even if you have no time to meet someone repeatedly, you can always take out sometime and chat with him online.For Her: Why online dating is best for you?

Now tell me, what happens when a guy asks you out or asks you for your number? You simply share it with him, if the feelings are mutual, and go on the first date with him. However, there are a lot of women that don't like the men they date on the very first date itself; this is where you wish to ignore him, but if he has your number or he doesn't turn out to be safe enough, he starts irritating you by flooding your phone with thousands of text messages.On the other hand, you don't need to share your number with the guy until you trust him. You can simply chat for as long as you want, get to know him better, meet him once or twice and then share the number if you really like him.

There are different profiles that you get to see on online dating websites; therefore, you have the power to choose whom you wish to contact and whom you wish to ignore.

For him: Why online dating is best for you?

What is that biggest fear in the heart of a man? To get rejected by the woman he likes. It is more like an insult caused to him when his proposal is turned down by the one he genuinely likes. But thanks to online dating websites, nobody comes to know who all have rejected you. There are a lot of beautiful women out there that have their profiles on dating websites and you can easily get in touch with a few of them.Most of the men prefer witty women that have excellent brains on their beautiful faces; if you are one of them, online dating is the best service for you because no one can be wittier than a woman with an excellent control on her words; an intelligent chatter

is, perhaps, a smart talker

is, perhaps, a smart talker .

. Why online dating is better than traditional dating?

The most important benefit of using the concept of online dating is that you are completely safe in the virtual world. You don't have to accept all those dating offers that you get from different people. Besides, you get your own sweet time to understand a person who has approached to you, get to know him in a better way, know whether he or she can be trusted or not and then go ahead with the very first date.Online dating is always better than traditional dating since it doesn't frustrate you. If you contact different people and try your level best to get a perfect date with all your efforts, you do!

Why use a free dating website?

Instead of using paid dating websites, it is better to use free dating websites. The most important benefit of using a free dating website is that you don't need to invest or bribe someone to get yourself a date. It is always good to use a website that lets you explore the world of online dating, instead of insisting you to pay and then hunt for the right partner.

bribe someone to get yourself a date. It is always good to use a website that lets you explore the world of online dating, instead of insisting you to pay and then hunt for the right partner. Real Free No Membership Hook Up Usa Inc

Most of the men and women prefer free dating websites since you don't need to invest anything in them. All you need to do is find such a website, create your profile, explore different profiles and send interests to different people you like. You are also free to share your number with the ones that you like or BLOCK those that you dislike.